Disclaimer: Fabbalancecheck.co is an unofficial platform offering educational and informational content only. We are not affiliated with or endorsed by First Abu Dhabi Bank (FAB). The official website of FAB is https://www.bankfab.com. All logos, videos, and trademarks displayed on this website are the property of their respective owners.

Fab Balance Check

To check your FAB bank balance (First Abu Dhabi Bank (FAB) account balance), enter the last two digits of your FAB ATM card in the first box. Next, input your Card ID number in the second box. Click the “Go” button to proceed. The dashboard will display your current balance and other important details. This process is quick and user-friendly.

FAB Balance Check

What is First Abu Dhabi Bank (FAB)?

First Abu Dhabi Bank (FAB) is the largest bank in the United Arab Emirates (UAE) and ranks among the world’s leading financial institutions. FAB provides an extensive range of banking products and services, including Corporate and Investment Banking and Personal Banking, catering to diverse customer needs globally.

Recognized for its financial strength and stability, Global Finance ranked FAB as the safest bank in the UAE and the Middle East. The Banker’s Top 1000 World Banks 2020 listed FAB as the top bank in the UAE, second in the Middle East, and 85th globally based on Tier 1 capital. FAB also ranked 109th globally by total assets.

In Forbes’ Global 2000 largest public companies, FAB secured the top position in the UAE, 4th in the Arab world, and 303rd globally. These achievements highlight FAB’s excellence in delivering secure and reliable financial services worldwide.

For FAB customers, staying updated on FAB Account balances and salary deposits is simple and secure. The FAB Prepaid Card Inquiry Portal and FAB Mobile App offer fast access to your banking details.

What is FAB Balance Check?

FAB Balance Check allows customers of First Abu Dhabi Bank (FAB) to easily monitor their account balances, including salary deposits. This feature ensures users have instant and secure access to their financial information. FAB provides various platforms for balance inquiries, such as the FAB Prepaid Card Inquiry Portal, FAB Mobile App, and ATM services.

To check your balance online, visit the FAB Prepaid Card Inquiry Portal. Enter the last two digits of your FAB ATM card in the first field and your Card ID number in the second field. After filling in the details, click the “Go” button, and your balance, along with other essential account information, will display on the dashboard.

Additionally, the FAB Mobile App provides a user-friendly experience for balance checks and salary inquiries. These tools make it simple for customers to stay updated on their finances anytime, anywhere.

How to check you FAB Balance online in 2025? (Quick Answer)

To check you FAB Balance online in 2025 follow below steps:

- Visit the Official FAB Website: Go to the FAB website and navigate to the Card Services page.

- Enter Card Details: Input your card’s last two digits and Card ID number.

- Click “Go”: Proceed by clicking the “Go” button.

- View Balance: Your current balance will appear along with recent transactions.

Alternatively, use the FAB Mobile App for easy access on the go.

Different Methods to Check FAB Balance Online in 2025 : Step-By-Step

First Abu Dhabi Bank (FAB) provides multiple ways for customers to check their account balances conveniently. Below are step-by-step methods, explained in detail, to help users access their FAB balance information seamlessly.

1. FAB Balance Check via the Official FAB Website

Checking your balance through the official FAB website is straightforward and secure. Follow these steps:

1. Visit the FAB Website:

Go to the official FAB website and navigate to the Card Services page or the Prepaid Card Inquiry Portal.

2. Enter Card Details:

Input the last two digits of your FAB ATM card in the first field and your Card ID number in the second field.

3. Click “Go”:

Once you’ve entered the details, click the “Go” button to proceed.

4. View Balance:

The system will display a dashboard containing your current balance and other essential details, such as recent transactions.

This method ensures accurate information and is accessible from any device with an internet connection. It’s ideal for users who prefer using a web browser for banking.

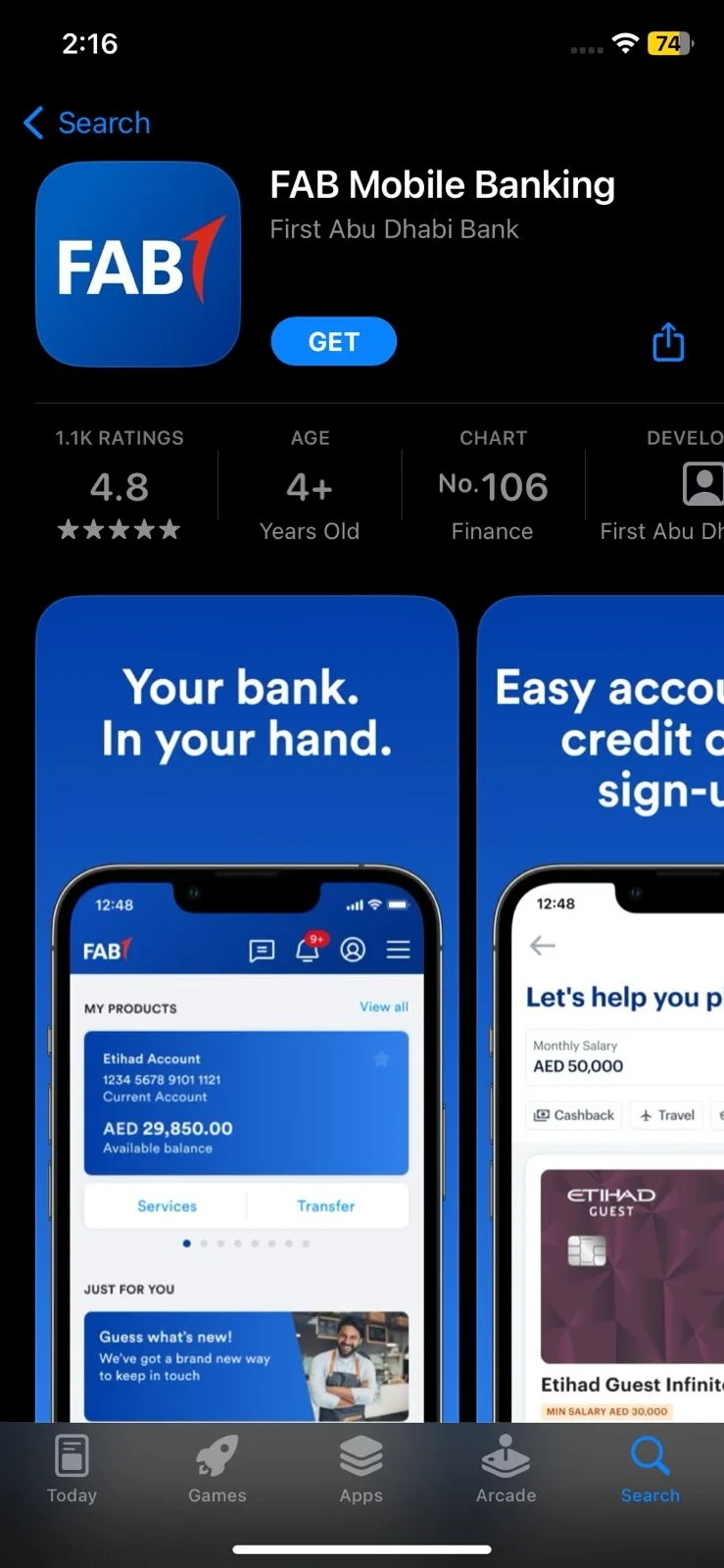

2. FAB Balance Check via the FAB Mobile App

For customers seeking convenience, the FAB Mobile App offers a user-friendly and efficient way to check account balances. Here’s how:

- Download the App: Install the FAB Mobile Banking App from the Google Play Store (for Android) or the Apple App Store (for iOS).

- Log In: Open the app and log in using your username and password. If you don’t have an account, register by following the app’s prompts.

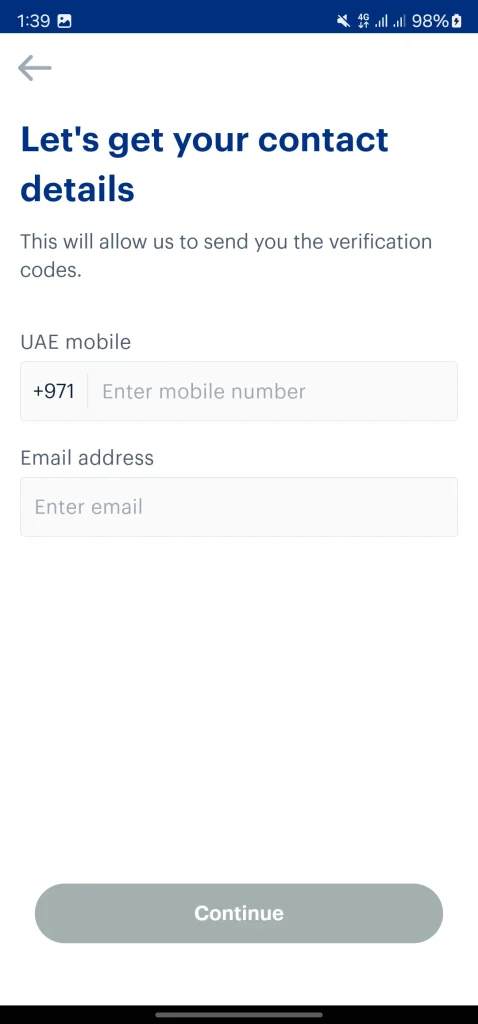

- Verify Your Account: Confirm your details, such as your mobile number and email address, during the login process.

- Check Balance: Once logged in, your account balance will appear on the home screen. You can also view additional details, including recent transactions, debit, and credit histories.

This method is particularly useful for customers who need quick and consistent access to their account information on the go.

3. FAB Balance Check via FAB Bank ATM

For those who lack internet access or face connectivity issues, using an ATM is an excellent offline method to check your balance. Follow these steps:

- Visit a Nearby ATM: Locate the nearest FAB ATM and carry your FAB debit card with you.

- Insert Your Card: Place your debit card into the ATM slot.

- Input Your Account Details: Enter your ATM PIN and account credentials when prompted.

- Select “Check Balance”: From the menu options, choose the “Check Balance” feature.

- View Balance: The ATM will display your current balance on the screen.

Before leaving, ensure that you retrieve your debit card and log out to protect your account. This method is reliable for users who need immediate access without relying on internet services.

4. FAB Balance Check via Customer Care Phone Number

If you do not have internet access and cannot visit an ATM, you can check your balance by contacting FAB’s customer care service. Here’s how:

- Dial the Official Number: Call 600-52-5500 for customers in the UAE or +971-268-1151 for international inquiries.

- Listen to the IVR Options: Follow the prompts in the Interactive Voice Response (IVR) menu until you hear the balance inquiry option.

- Select Your Language: Choose a preferred language to ensure clarity during the call.

- Check Balance: Select the “Balance Check” option, and the system will provide your current account balance.

This method is efficient for individuals who prefer human assistance or when digital tools are unavailable. Ensure you use the official FAB phone numbers to avoid scams or fraudulent calls.

Why Do You Need a FAB Bank Account in Dubai?

Having a First Abu Dhabi Bank (FAB) account in Dubai is essential for individuals and businesses due to its crucial role in managing financial activities, meeting residency requirements, and accessing local services. Dubai’s status as a global business hub requires individuals and entities to establish local banking relationships for seamless financial operations. Below are the detailed reasons why a FAB bank account is indispensable:

1. Residency Visa Compliance

Opening a UAE bank account is mandatory for obtaining a residency visa. Whether for individuals or businesses, local banking ensures compliance with UAE regulations and smooth processing of residency-related formalities.

2. Salary Transfers

Employers in Dubai prefer to transfer salaries directly into UAE-based bank accounts, adhering to the Wages Protection System (WPS). A FAB bank account ensures secure and timely salary payments, making it a reliable choice for employees.

3. Access to Local Services

Many government and private services require a UAE bank account for financial transactions. A FAB account simplifies routine activities such as utility bill payments, school fees, and subscription renewals.

4. Business Operations

For businesses, having a FAB corporate account facilitates efficient payroll processing, managing transactions, and maintaining cash flow. It is a critical tool for complying with UAE laws and managing operational expenses effectively.

5. Credit and Loan Facilities

FAB offers a range of credit facilities, such as personal loans, business loans, and credit cards. Holding a FAB account simplifies access to these financial services, helping individuals and businesses manage their financial needs.

6. International Transactions and Currency Exchange

FAB accounts enable secure and seamless international transfers and currency exchanges. This is particularly beneficial for expatriates and businesses involved in global trade, as FAB offers competitive exchange rates and secure transfer processes.

7. Property Ownership and Investments

Owning property in Dubai often requires a local bank account. FAB supports property investors with specialized accounts such as investment accounts, offering returns between 3% and 7% annually. These services also help manage finances related to real estate investments.

Reasons to Open a FAB Bank Account in Dubai

| Reason | Details | Benefit |

| Residency Visa Compliance | A UAE bank account is mandatory for residency visa processing. | Ensures compliance with UAE regulations and smooth formalities. |

| Salary Transfers | Employers transfer salaries directly to UAE-based accounts under the Wages Protection System (WPS). | Enables secure and timely receipt of salary payments. |

| Access to Local Services | Many government and private services require a local bank account. | Simplifies utility bill payments, school fees, and subscriptions. |

| Business Operations | Corporate accounts facilitate payroll processing, transactions, and cash flow management. | Helps businesses comply with UAE regulations and operate efficiently. |

| Credit and Loan Facilities | Offers access to personal loans, business loans, and credit cards. | Simplifies obtaining financial support for personal and business needs. |

| International Transactions & Exchange | Enables secure currency exchange and international fund transfers. | Supports expatriates and businesses in global trade with competitive exchange rates. |

| Property Ownership and Investments | Required for managing property investments and offers returns on investment accounts (3%–7% annually). | Simplifies property-related financial management and offers growth opportunities. |

FAB Bank Account Types for UAE Residents

First Abu Dhabi Bank (FAB) offers a variety of account types to meet the financial needs of individuals and businesses in the UAE. Each account is designed with unique features tailored to specific purposes, ensuring flexibility and convenience for customers.

| Account Type | Features | Ideal For |

| Current Accounts | Simplifies daily transactions with easy access to funds. | Employees and individuals with regular cash flow needs. |

| Savings Accounts | Provides higher interest rates, limited withdrawals, and potential penalties for early access. | Individuals who want to grow their savings over time. |

| Investment Accounts | Offers financial tools for investments with annual returns ranging from 3% to 7%. | Investors seeking diversified growth opportunities. |

| Offshore Accounts | Enables international fund transfers, tax benefits, and legal advantages. | Individuals and businesses with cross-border financial activities. |

FAB Bank Account Categories

1. Personal Accounts for UAE Residents

UAE residents can open personal accounts within 1-3 days with minimal documentation. These accounts cater to salaried employees, freelancers, and professionals seeking reliable banking solutions.

2. Personal Accounts for Non-Residents

Non-residents can also open FAB accounts; however, the process takes longer (4-6 weeks) and requires additional documentation, such as proof of income and international identification.

3. Corporate Accounts

FAB corporate accounts are designed for businesses operating in:

- UAE Free Zones: Suitable for companies in tax-free areas.

- Mainland UAE: Ideal for businesses operating under UAE labor and corporate laws.

- Offshore Jurisdictions: Beneficial for international companies with UAE operations.

These accounts enable businesses to manage payroll, handle transactions, and meet compliance standards efficiently.

How to Open a FAB Bank Account in 2025? Step-by-Step Guide

Opening a First Abu Dhabi Bank (FAB) account in 2025 is straightforward, with flexible options to cater to your preferences. Follow the step-by-step guide below to ensure a smooth and efficient account opening process.

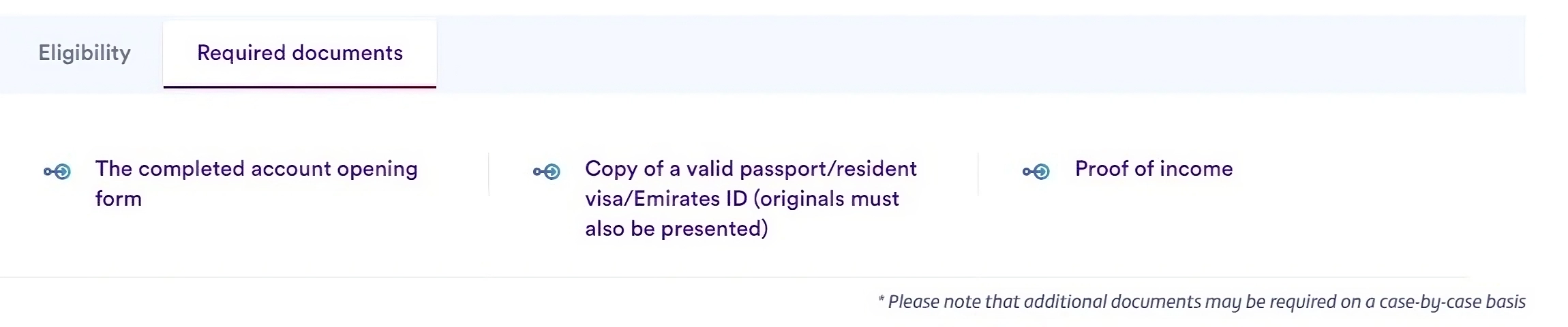

Step 1: Gather Required Documents

Before starting the application process, ensure you have the following documents prepared. These are mandatory for account approval:

- Valid Passport: Provide both the original and a photocopy.

- Residency Visa: Submit a copy of your UAE residency visa.

- Emirates ID: Include the original and a copy of your Emirates ID.

- Salary Certificate or Labor Contract: Required for salaried individuals to verify employment and income.

- Company License and Partnership Agreement: Necessary for business accounts, especially for corporate or partnership ventures.

- Tenancy Contract: May be required to validate your UAE residence, depending on the account type.

Ensuring all documents are accurate and up to date will speed up the approval process and avoid delays.

Step 2: Choose Your Preferred Method

FAB offers three convenient ways to open a bank account. Choose the method that best suits your needs:

Option 1: Through the FAB Website

Opening an account online via the FAB website is a convenient option for tech-savvy users. Follow these steps:

- Visit the Official FAB Website: Access FAB’s Official website at https://www.bankfab.com

- Locate the Account Opening Section: Find the relevant section dedicated to account applications.

- Complete the Online Application Form: Fill in accurate personal details, including your name, contact information, and employment details.

- Upload Required Documents: Attach scanned copies of the necessary documents listed above.

- Submit the Application: Double-check your details and submit the form for processing.

After submission, FAB will review your application and notify you via email or phone about the account’s status and further steps.

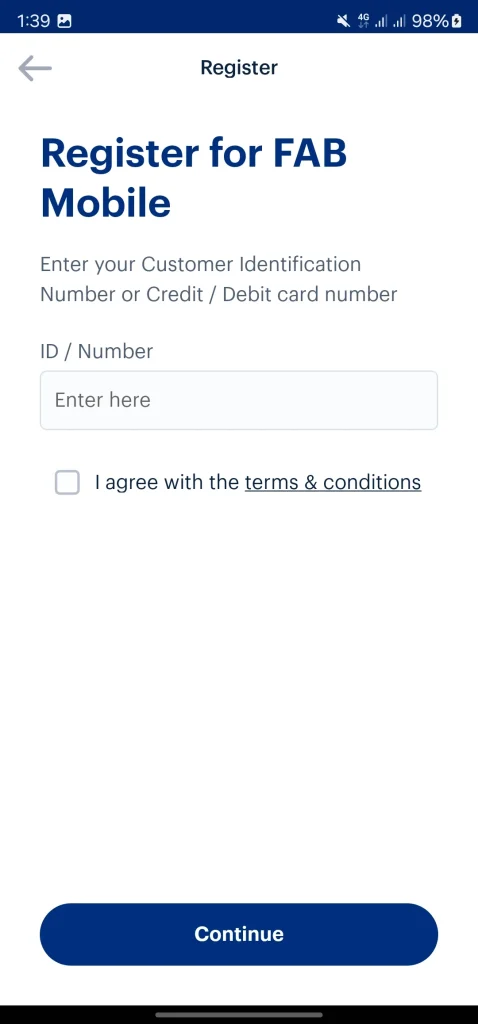

Option 2: Using the FAB Mobile App

For those who prefer banking on the go, the FAB Mobile App offers a user-friendly and secure platform to open an account. Follow these steps:

- Download the App:

- For Android users, visit the Google Play Store.

- For iOS users, access the Apple App Store.

- Register as a New User: Use your mobile number and email address to create a new account on the app.

- Fill in the Application Form: Enter your personal and professional details, ensuring accuracy to avoid discrepancies.

- Upload Documents: Take clear pictures or upload PDFs of the required documents directly through the app.

- Complete Verification:

- FAB will send a One-Time Password (OTP) to your registered mobile number or email for verification.

- Enter the OTP to confirm your identity and complete the application process.

Once the verification is successful, you will receive a notification about your account approval and activation.

Option 3: Visiting a FAB Branch

For those who prefer in-person assistance, visiting a FAB branch is an excellent option. Follow these steps:

- Locate the Nearest FAB Branch: Use FAB’s website or mobile app to find a branch near you.

- Submit Required Documents: Bring the original and copies of the documents mentioned earlier. Hand them to the bank representative for review.

- Fill Out the Application Form: Complete the account opening form with assistance from the FAB staff to ensure all details are accurate.

- Receive Confirmation: After submitting the form and documents, the bank will process your application and notify you when the account is ready.

This method is ideal for those who need personalized guidance or have questions about the process.

Step 3: Activate Your FAB Account

Once your FAB account is approved, follow these steps to activate it for online and mobile banking services:

- Download the FAB Mobile App:

- Available on the Google Play Store and Apple App Store.

- Register for Mobile Banking:

- Use your account number, mobile number, and email to register.

- Set up a secure password and username for login.

- Verify Your Account:

- FAB will send an OTP to your registered contact details.

- Enter the OTP to confirm your identity.

- Login and Access Services:

- Log in to the FAB app to check your balance, transfer funds, and pay bills.

- Explore additional features such as savings tools, loan applications, and investment options.

What Is the Minimum Balance in a FAB Account?

To maintain a personal savings account with First Abu Dhabi Bank (FAB), you are required to keep a minimum balance of 3,000 AED in your account. Falling below this threshold incurs a monthly penalty of 10 AED. This condition is applicable only to savings accounts, as other types of accounts, such as Elite Saving Accounts, are exempt from minimum balance requirements. For these accounts, FAB allows cash deposits and withdrawals without maintaining a minimum balance, providing flexibility to its users.

What is the FAB Bank Customer Care Number?

FAB Bank ensures efficient and accessible customer support through multiple channels. Customers in the UAE can contact FAB’s customer care team at 600 525 500 for inquiries and assistance. For international calls, the dedicated helpline is +971 2 681 1511. FAB also provides customer support through its official website and social media platforms, including Facebook, Twitter, Instagram, and LinkedIn.

In case of delayed responses from the customer care team, customers can drop their concerns via social media or email. These diverse communication options allow users to get timely help and stay connected with the bank for any service-related issues.

Benefits of the FAB Balance Check Service

FAB’s balance check service is designed to provide convenience and security to its customers. The service offers several key benefits:

- 24/7 Accessibility: Customers can check their account balances anytime and from anywhere using online or mobile banking platforms.

- Time-Saving: Avoids trips to the bank or ATM, saving valuable time.

- Real-Time Updates: Provides instant updates on account balances and transactions.

- Multiple Platforms: Offers balance inquiry options via website, mobile app, ATMs, and phone banking.

- User-Friendly: Simplified interface across all platforms for a seamless experience.

- No Charges: Balance checks through the mobile app or website are free of charge.

- Secure Transactions: Protected login and encrypted data ensure the safety of account details.

- Offline Accessibility: The SMS balance check feature enables users to access account information without an internet connection.

These features make FAB’s balance check service highly reliable and efficient for customers managing their finances.

FAB Balance Check in Dubai (2025)

Dubai’s dynamic banking system integrates global standards, and First Abu Dhabi Bank (FAB) is a prime example of innovation and convenience. For residents and entrepreneurs operating in Dubai, a FAB bank account is essential for managing international and local transactions. To check your FAB balance in Dubai:

- Visit FAB’s official website or log in to the FAB Mobile App.

- Enter your login credentials securely.

- Access your balance details instantly.

Alternatively, customers can use ATMs or contact customer care to check balances. These flexible options cater to a variety of customer needs, ensuring efficiency in Dubai’s fast-paced financial environment.

FAB Balance Check in Abu Dhabi (2025)

As the leading bank in the UAE, FAB offers comprehensive banking services to millions of residents and visitors in Abu Dhabi. Checking your FAB balance in Abu Dhabi is straightforward:

- Use the FAB Mobile App or visit the official website to log in with your credentials.

- Check your account balance directly from the dashboard.

For those preferring offline methods, FAB ATMs and the customer support hotline are readily available. These options ensure that customers in Abu Dhabi have seamless access to their banking details.

What is the FAB Bank SWIFT Code?

The SWIFT code is a globally recognized identifier for banks and financial institutions, facilitating secure and efficient international transactions. FAB’s SWIFT code is NBADAEAAXXX, used for both domestic and international money transfers. This code ensures accurate identification of FAB during global financial transactions, adhering to the standards of the Society for Worldwide Interbank Financial Telecommunication (SWIFT). Customers can rely on this secure system for all their cross-border financial activities.

FAB Ratibi Card Balance Inquiry

Checking the balance of a FAB Ratibi Prepaid Card is simple and convenient. Follow these steps:

- Visit the FAB Prepaid Card Inquiry Portal on the official FAB website.

- Enter your card number and Card ID.

- Click the “Go” button to view your current balance.

This service is especially helpful for new users, offering an easy-to-use platform for managing their Ratibi card balances.

FAB Bank Credit Card Cashback Rewards (2025)

FAB offers cashback credit cards with exceptional rewards, tailored to meet customers’ spending needs. Key benefits include:

- 5% Cashback: On supermarket purchases, school fees, dining, and non-AED expenses.

- 10% Cashback: On hotel bookings for travel enthusiasts.

- 1% Cashback: On non-AED expenses outside the UAE.

- 0.15% Cashback: On all AED-based spending within the UAE.

- Free Airport Lounge Access: Unlimited entry to 10 airport lounges globally.

- Dining Discounts: Up to 20% off on food and drinks.

- Food Delivery Offers: Enjoy a 20% discount on grocery and food delivery through Talabat with promo code “MASTERCARD”.

These benefits make FAB cashback credit cards an ideal choice for customers looking to maximize savings and enjoy premium lifestyle perks.

FAB Rewards Platinum Credit Card Benefits

The FAB Rewards Platinum Credit Card offers a range of exclusive lifestyle and travel benefits:

- Visa Lifestyle Perks: Discounts on dining and shopping through Visa’s global network.

- Travel Discounts: Reduced rates on travel bookings with Visa partners.

- Movie Tickets: Monthly access to complimentary tickets at specific locations.

- Purchase Protection: Extended warranty and purchase protection for enhanced safety.

- Travel Insurance: Includes international medical assistance and travel protection.

- Credit Shield: Safeguards outstanding balances with added security.

This credit card is designed for frequent travelers and professionals, combining convenience with comprehensive protection.

Blue FAB Credit Card by Al-Futtaim

The Blue FAB Credit Card by Al-Futtaim offers unparalleled rewards and cashback opportunities:

- Exclusive Al-Futtaim Offers: Access exclusive discounts and benefits across Al-Futtaim brands.

- 5% Cashback: Earn rewards for shopping locally and internationally.

- 1% Cashback: On every AED spent outside the Al-Futtaim network.

- Additional Rewards: Receive an extra 1% cashback via the Blue App for eligible purchases.

- 0% Easy Payment Plan (EPP): Spread payments over 12 months with no interest at Al-Futtaim stores.

- Balance Transfer Benefit: Enjoy 0% balance transfer for up to 12 months if done within the first 90 days of issuance.

These features make the Blue FAB Credit Card a versatile choice for customers seeking financial flexibility and rewards across various spending categories.

Frequently Asked Questions

Q. How can I check my FAB bank transaction history?

You can check your FAB bank transaction history by logging into the FAB Mobile App or the official FAB website. Use your credentials to access the account details and select the option to view or download your transaction history. This process is safe and encrypted, ensuring the security of your financial data.

Q. What is the minimum balance requirement for a FAB savings account?

For a FAB personal savings account, you need to maintain a minimum balance of 3,000 AED. If the account balance falls below this amount, the bank charges a monthly penalty of 10 AED. However, some accounts, such as Elite Savings Accounts, do not require a minimum balance.

Q. How can I check my FAB salary account balance?

To check your salary account balance, use the FAB Mobile App or visit the official website. Log in using your account details. You can also check your balance through a FAB ATM or by calling customer support.

Q. What is the contact number for FAB customer support?

You can reach FAB customer support in the UAE by dialing 600 525 500. For international inquiries, call +971 2 681 1511. FAB also provides assistance through its official website and social media platforms, including Facebook and Twitter.

Q. What documents do I need to open a FAB bank account?

To open a FAB account, you need the following:

- A valid passport (original and copy).

- A copy of your UAE residency visa.

- Your Emirates ID.

- A salary certificate or labor contract for salaried individuals.

- A trade license for business accounts.

Q. How can I check my FAB Ratibi card balance?

To check your FAB Ratibi card balance, go to the FAB Prepaid Card Inquiry Portal on the official website. Enter your card number and Card ID, then click “Go” to view your balance instantly.

Q. What is the SWIFT code for FAB?

The SWIFT code for First Abu Dhabi Bank (FAB) is NBADAEAAXXX. This code is used for secure international money transfers and ensures accurate identification during financial transactions.

Q. How can I apply for a FAB credit card?

You can apply for a FAB credit card by visiting the official FAB website or using the FAB Mobile App. Select the credit card that suits your needs, fill out the application form, and upload the required documents. Once your application is approved, the bank will issue your card.

Q. How do I activate the FAB Mobile Banking App?

Download the FAB Mobile App from the Google Play Store or Apple App Store. Register as a new user by entering your mobile number, account details, and a secure password. Verify your account using the OTP sent to your registered mobile number or email. After verification, log in to access banking services.

Q. Can a non-resident open a FAB bank account?

Yes, FAB allows non-residents to open accounts. The process takes approximately 4 to 6 weeks and requires additional documents such as proof of income and a valid international identification. Ensure all documents are accurate to avoid delays.

Disclaimer: Fabbalancecheck.co is an independent platform providing educational and informational content only. We are not affiliated with or endorsed by First Abu Dhabi Bank (FAB). The official website of FAB is https://www.bankfab.com. All logos, trademarks, and materials mentioned are the property of their respective owners.

Contents

- 1 Fab Balance Check

- 1.1 What is First Abu Dhabi Bank (FAB)?

- 1.2 What is FAB Balance Check?

- 1.3 How to check you FAB Balance online in 2025? (Quick Answer)

- 1.4 Different Methods to Check FAB Balance Online in 2025 : Step-By-Step

- 1.5 Why Do You Need a FAB Bank Account in Dubai?

- 1.6 Reasons to Open a FAB Bank Account in Dubai

- 1.7 FAB Bank Account Types for UAE Residents

- 1.8 FAB Bank Account Categories

- 1.9 How to Open a FAB Bank Account in 2025? Step-by-Step Guide

- 1.10 What Is the Minimum Balance in a FAB Account?

- 1.11 What is the FAB Bank Customer Care Number?

- 1.12 Benefits of the FAB Balance Check Service

- 1.13 FAB Balance Check in Dubai (2025)

- 1.14 FAB Balance Check in Abu Dhabi (2025)

- 1.15 What is the FAB Bank SWIFT Code?

- 1.16 FAB Ratibi Card Balance Inquiry

- 1.17 FAB Bank Credit Card Cashback Rewards (2025)

- 1.18 FAB Rewards Platinum Credit Card Benefits

- 1.19 Blue FAB Credit Card by Al-Futtaim

- 1.20 Frequently Asked Questions

- 1.20.1 Q. How can I check my FAB bank transaction history?

- 1.20.2 Q. What is the minimum balance requirement for a FAB savings account?

- 1.20.3 Q. How can I check my FAB salary account balance?

- 1.20.4 Q. What is the contact number for FAB customer support?

- 1.20.5 Q. What documents do I need to open a FAB bank account?

- 1.20.6 Q. How can I check my FAB Ratibi card balance?

- 1.20.7 Q. What is the SWIFT code for FAB?

- 1.20.8 Q. How can I apply for a FAB credit card?

- 1.20.9 Q. How do I activate the FAB Mobile Banking App?

- 1.20.10 Q. Can a non-resident open a FAB bank account?